Peter A. Diamond

Biographical

My grandparents immigrated to the U.S. around the turn of the last century. My mother’s parents and six older siblings came from Poland. My father’s parents met in New York, she having come from Russia and he from Romania. My parents, both born in 1908, grew up in New York and never lived outside the metropolitan area. Both finished high school and went to work, my father studying at Brooklyn Law School at night while selling shoes during the day. When they married in 1929, my mother was earning $15 a week as a bookkeeper and my father, $5 a week as a novice lawyer.

My grandparents immigrated to the U.S. around the turn of the last century. My mother’s parents and six older siblings came from Poland. My father’s parents met in New York, she having come from Russia and he from Romania. My parents, both born in 1908, grew up in New York and never lived outside the metropolitan area. Both finished high school and went to work, my father studying at Brooklyn Law School at night while selling shoes during the day. When they married in 1929, my mother was earning $15 a week as a bookkeeper and my father, $5 a week as a novice lawyer.

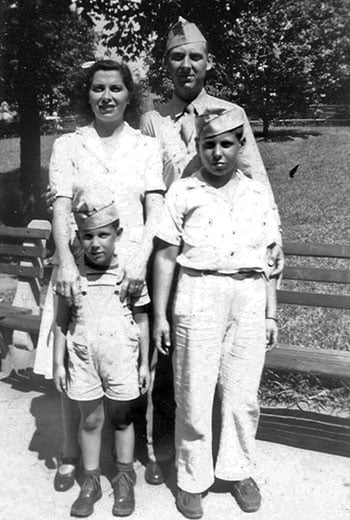

My brother, Richard, was born in 1934 and I in 1940. My father continued to practice law until his late 80s, but my mother had left the paid labor force by the time of my birth. She volunteered in a number of organizations after that, often serving as treasurer, drawing on her bookkeeper background. In more recent times, with better opportunities for women, she would have had a good career.

I started public school in the Bronx, and switched to suburban public schools in second grade when the family moved to Woodmere, on Long Island. Our house faced the Long Island Rail Road and was so close to the tracks that the family thought the first train at 5 AM was coming through the bedrooms.

Figure 1. Diamond with older brother Richard and parents, summer, 1944, Battle Creek Michigan, where his father was stationed.

After high school, I went to Yale. I have joked that I loved college and just never left. After considering a major in engineering, I chose math instead. I learned how to do a rigorous mathematical proof from Shizuo Kakutani, who taught the class in real analysis. He had proved a fixed-point theorem that plays a key role in some economic analyses.

In my second year at Yale, I took a year-long introductory economics course from Charles Berry. He interested me in economics and became a friend. In the following year, at Berry’s suggestion, I took the year-long intermediate honors theory class, taught by Ed Budd. This increased my interest in economics enough so that I broke off my study of French to take the graduate mathematical economics course taught by Gerard Debreu, based on his newly published Theory of Value. Debreu was an outstanding teacher, and my early and thorough grounding in general equilibrium theory has stood me in good stead ever since, shaping my thinking about economics. At the same time I was studying game theory in the seminar for senior honors math majors and graduate math classes in Algebra and Topology.

My first job as an economist (sort of) was as a research assistant for Tjalling Koopmans for the summer of 1960. I shared an office with T.N. Srinivasan and got to hang out in the Cowles Foundation, with its memorable coffee time discussions. I was hired to help with the mathematics. When asked to produce an example of a function with certain properties, I found it easier to produce a class of functions with the desired properties, rather than cranking out a single example. That led Koopmans to reorient his research plan, giving this class of functions a central role, and to promote me to co-author for my first publication (appearing in 1964). I had had no idea that the class of functions would be interesting, and have come to recognize that an important part of education is learning to recognize the value of what you stumble over, as well as choosing research topics with a sense of how valuable possible findings might be. I have always viewed this splendid economist and splendid person as a role model for how to do economics and how to relate to people.

In light of my interest in both math and economics, I applied to graduate schools in both subjects, but settled on the MIT math department. My plan was to take micro and macroeconomics and complex and real variables, deciding at the end of the year which was the better career route. But the complex variables class conflicted with both micro and macro. I decided to drop complex variables, figuring I could pick it up in the summer if economics didn’t hold me. The math graduate registration officer (GRO), George Thomas, who had written the calculus book I had learned from, thought I should be advised by the economics department. He simply transferred me (along with my fellowship) to the economics department and GRO Bob Solow. Bob promptly added statistics and economic history to my class load.

I enjoyed economic theory and didn’t enjoy real variables (and I was better at economics). It seemed to me that the real variables class was about proving the same theorem about integration over and over, in more and more general settings. I found the generalizations of no interest, perhaps because I was ignorant of what could be done with more general versions that couldn’t be done otherwise. As an economist, I have always been more interested in working on models generating new insights, and not much in generalizations, as important as they sometimes are. So my experimentation ended after one semester.

The public finance class, taught by E. Cary Brown, was, for me, a key part of the normal two-year course load. We worked through everything in the newly published The Theory of Public Finance by Richard Musgrave, an outstanding scholar who had written an exceptional book. Musgrave’s drive to put public finance on a general equilibrium basis was important for my development and fitted well with the general equilibrium orientation that I had acquired from the class with Debreu. This background played a central role in my later work on optimal taxation.

My thesis, supervised by Bob Solow, had one essay that took a different approach to the same questions I had worked on with Koopmans, and two essays in growth theory. One of them built on work of Srinivasan and one on work of Solow and of W.E.G. Salter, whose book Solow brought to my attention at a time when I was failing to find a topic for the needed third essay. Solow was and is an outstanding economist, a splendid person and a good friend. He has supervised a large fraction of MIT dissertations. He and Koopmans have been my role models. More generally, MIT was (and is) a terrific place to be a graduate student, to get an outstanding and broad education, while having a good time. And it has been a terrific place to be a faculty member. The students, both undergraduate and graduate, have provided stimulating teaching opportunities, both pleasurable and educational for me, and a series of outstanding research assistants. My colleagues, for whom I have always had the greatest affection and admiration, have functioned as a team, with open doors and profound interest in encouraging the students. They have kept me interested and informed over a wide range of economics topics, have helped with my research, including joint authorship, have joined in the smoothest running of a department one could imagine, and have been wonderful friends.

I landed a job at Berkeley as one of four new assistant professors who started in September 1963, having been recruited by Andy Papandreou, shortly before he returned to Greece. Among the four of us are three Nobel Prizes. In 1963–64, Berkeley was a perfect place to be a young theorist. The junior faculty interacted all the time, and became the best of friends. Particularly important for me were Dan McFadden, Bernie Saffran, and Sid Winter. The senior faculty were supportive. Together with Tibor Scitovsky, I taught the graduate micro-macro sequence (one semester of each). I also taught a year-long undergraduate public finance class, which had a prerequisite of intermediate theory. I taught public finance again the following year, along with money and banking. The theory prerequisite and the length of the public finance class allowed for a thorough exploration of topics, and introduced me to the experience of discovering results leading to good papers as part of developing material for a class of sharp, attentive students. My first such experience led to my 1965 paper on the public debt. While many are concerned about the tension between teaching and research, my experience is that they reinforce each other. Indeed, the times when I had the most difficulty in finding good research topics have occurred when I did little teaching.1

Berkeley was a great place for me at the time for more reasons than good teaching and research opportunities. Top of the list was meeting my wife Kate (real name Priscilla Myrick), a student in law school at the time I started teaching economics. Despite the fact that I was teaching public finance and she found taxation to be her least favorite class, there was enough attraction that we married in 1966, shortly after I returned to MIT.

Figure 2. Wedding photo, October 1966.

For more on how valuable teaching has been for my research, and for the diverse ways I approached finding and choosing topics to work on, see Moscarini and Wright, 2007 and Diamond, forthcoming.

Berkeley also gave me the opportunity to witness the start of the student uprisings, with the Free Speech Movement of 1964. I watched the repeated mistakes of the Berkeley administration, mistakes repeated again and again by university administrations across the country. Being part of a faculty trying to help, but not succeeding much, was quite an education.

One of the pleasures of an academic career is the opportunity to visit places, for short times and, especially valuable, for long ones. My first year of leave was 1964-5, after just two years of teaching. I was an Overseas Fellow at Churchill College, Cambridge, an opportunity organized for me by Frank Hahn. Having Frank as a colleague was one of the prime attractions for going to Cambridge. Talking economics with him lived up to expectations, and we became good friends. Living in college, meeting scholars from an array of fields, spending lots of time in the economics faculty, and tutoring a few outstanding students was terrific.

In the early spring there arrived one of those blue air letters, which one rarely sees any more, from Bob Solow, asking if I would have any interest in returning to MIT. Expecting to accept, I promptly altered my plan for the rest of my leave and returned to Berkeley to see Kate, before heading for MIT. I proposed in October, and we were married 10 days later. Our marriage, and our sons, Matt (born 1972) and Andy (born 1979), and the love we all share, have shaped, enlivened, and enriched my life in ways I could not anticipate as a young single man. They are three great people.

Family and economics have been the two poles around which I function, one a source of great joy and the other of great pleasure. As a 70th birthday gift, Kate commissioned a piece of music from John Harbison in my honor, titled “Diamond Watch: Double Play for Two Pianos.” And she arranged for me to throw out the ceremonial first pitch at Fenway Park, home of the Boston Red Sox, as I had dreamed of doing for many years. A photo of that pitch, and one of the shirts worn by the graduate students at that game, were donated to the Nobel Museum. And my family has put up with my heavy commitment to work. Apart from following professional sports, economics is my only hobby – reading and writing, talking and listening. I do read a fair number of mysteries and enjoy looking at paintings with Kate, an art historian who was a Curatorial Associate at the Boston Museum of Fine Arts.

Having cut short my time at Churchill, and not having had a proper honeymoon, Kate and I returned to Churchill for the summer of 1967, the start of much wonderful traveling we have done together. Shortly after we arrived, I gave a seminar on optimal taxation, based on results that had come from teaching a graduate public finance class for the first time that year. Jim Mirrlees approached me after the seminar to point out that my model of a one-consumer economy was a good base for analyzing a many-person economy since I had set up the problem in price space instead of quantity space. That prices were the same for all households was key to that extension. We started joint research on optimal taxation that summer, and had essentially finished our first paper by the end of the summer, although it was not published until 1971.

Jim and I have written a dozen papers together over the years, having something in progress (sometimes very slowly) at all times. I think that the success of this collaboration has come from an ideal distance between the ways our minds work. Similar enough that communication is quick and thorough, but different enough that we did things that I suspect neither of us would have accomplished alone. (Even our rare miscommunications were sometimes fruitful, opening up an issue neither of us had recognized.) When collaborations leave you with that feeling it is very good, much much better than merely having shared the work. I have had positive experiences with a long list of collaborators, with very positive memories of all of my collaborations but one.

My next leave was 1968–69 and we each chose a place for an extended stay – Kate chose Nairobi and I chose Jerusalem. A hike up Mount Longonot, a dormant volcano in the Rift Valley shortly after we arrived in Kenya was practically the first time I had my feet off pavement. Both places were eye-opening, given how limited was my range of previous experiences. And our route home included two months with the Mirrlees family – a month in Oxford and a month with the two families sharing a place on the Mull of Kintyre. In the time before the Internet, finding good ways to be together played a key part in our collaboration and in our friendship.

Figure 3. Bob Solow, Paul Samuelson (teachers, colleagues, mentors and friends), Diamond, and John Castle at a reception for the MIT economics department, late 70s.

Since 1974, while continuing to do basic research, I have also been involved in policy analysis, primarily about pensions. Key to my work in this realm has been a series of enjoyable collaborations, with Bill Hsiao, Jerry Hausman, Jon Gruber, Peter Orszag, and Nick Barr. This started serendipitously when, at the recommendation of Paul Samuelson, Bill invited me to join the Panel on Social Security Financing consulting to the U.S. Senate Finance Committee, and I accepted. Pensions have been a perfect topic for me. They fit well in my public finance theory interests and with my social concerns. I have given many talks on Social Security, and ended some of them with a quote from Franklin Roosevelt, which I saw at his memorial in D.C.: “The test of our progress is not whether we add more to the abundance of those who have much; it is whether we provide enough for those who have too little.” (The Second Inaugural Address, January 20, 1937.)

For me, policy analysis and basic research are mutually supportive. Policy discussions have alerted me to interesting research questions that had not received adequate analysis. And my policy analysis draws heavily on my understanding of economic theory and reading in the empirical literature. Indeed, without being based on real understanding of how policies could accomplish good ends, making policy recommendations seems very hit or miss.

In 1992, I became the first holder of the Paul A. Samuelson chair. This pleased me greatly, and seemed to please him. Beyond being a great economist, as everyone knows, and, together with Bob Solow, the creator and shaper of the MIT Economics Department, Paul has always been a true friend. In 1997, I gave up the chair and became an Institute Professor.

I have worked in a large number of different areas. The kind of theoretical work I most enjoy is sorting out how to approach a problem to get insights, more so than refining models to shed further light on it. Thus, it was natural for me to explore new areas once I felt I had hit diminishing returns in one area. However, revisiting a topic after years away from it has been fruitful as well. Of the different areas in which I have worked, I want to discuss only how I came to do what was eventually recognized for this prize.

Figure 4. Dan McFadden, Diamond, Jim Mirrlees, close friends and co-authors, Stockholm, December 10, 2010.

My deep grounding in general equilibrium (Arrow-Debreu) theory includes a keen awareness of its limitations. The limitation that particularly interested me was the completeness of the coordination of agents that happens with complete competitive markets. For my first foray into changing the theory, I simply limited the set of available markets in a 1967 paper on the role of the stock market in resource allocation. Arrow-Debreu theory does not contain a mechanism or process for an economy to achieve its equilibrium allocation. In the 1960s there was ongoing work to find a hypothetical process that would converge to this equilibrium, with a focus on equations for price adjustment based on excess demands or supplies at tentative prices (referred to as tâtonnement). It struck me that the wrong question was being asked.

Figure 5. Diamond family, Matt, Peter, Kate, Andy, Stockholm, December 10, 2010..

For my second foray into changing the theory, rather than asking whether a process could be found that would converge to a standard competitive equilibrium, I decided to look for the allocation to which a plausible process would converge. This led first to my 1971 paper that applied search theory to a retail market. I then took thinking in terms of a process in real time to the law-and-economics question of the effects of alternative rules for breach of contract (jointly with Eric Maskin), and then to the labor market, and then to the entire economy. Dissatisfaction with (well-understood) analysis was part of the drive that led to this success; trying to get a more satisfactory perspective that would open up the ability to better answer economic questions was another part. And greatly enjoying the work itself mattered too.

This is still what I love doing and hope to continue.

| References |

| 1. Debreu, Gerard. 1959. Theory of Value: An Axiomatic Analysis of Economic Equilibrium. New Haven, CT and London UK: Yale University Press. |

| 2. Diamond, Peter. Forthcoming, 2011. “My Research Strategy.” In Szenberg, Michael, and Lall Ramrattan (eds.). 2011. Eminent Economists II – Their Work and Life Philosophies. New York: Cambridge University Press, New York. |

| 3. Moscarini, Giuseppe, and Randall Wright. 2007. “An Interview with Peter Diamond.” Macroeconomic Dynamics, 11: 543-565. doi:10.1017/S1365100507060403. |

| 4. Musgrave, Richard A. 1959. The Theory of Public Finance. New York: McGraw-Hill. |

This autobiography/biography was written at the time of the award and later published in the book series Les Prix Nobel/ Nobel Lectures/The Nobel Prizes. The information is sometimes updated with an addendum submitted by the Laureate.