Popular information

Information for the public:

The art of distinguishing between cause and effect in the macroeconomy (pdf)

Populärvetenskaplig information:

Konsten att skilja på orsak och verkan i makroekonomin (pdf)

The Prize in Economic Sciences 2011

How are GDP and inflation affected by a temporary increase in the interest rate or a tax cut? What happens if a central bank makes a permanent change in its inflation target or a government modifies its objective for budgetary balance? This year’s Laureates in economic sciences, Thomas J. Sargent and Christopher A. Sims, have developed methods for answering these and many other questions regarding the causal relationship between economic policy and different macroeconomic variables such as GDP, inflation, employment and investments.

The art of distinguishing between cause and effect in the macroeconomy

The economy is constantly affected by unanticipated events. The price of oil rises unexpectedly, the central bank sets an interest rate unforeseen by borrowers and lenders, or household consumption suddenly declines. Such unexpected occurrences are usually called shocks. The economy is also affected by more longrun changes, such as a shift in monetary policy towards stricter disinflationary measures or fiscal policy with more stringent budget rules. One of the main tasks of macroeconomic research is to comprehend how both shocks and systematic policy shifts affect macroeconomic variables in the short and long run. Sargent’s and Sims’s awarded research contributions have been indispensable to this work. Sargent has primarily helped us understand the effects of systematic policy shifts, while Sims has focused on how shocks spread throughout the economy.

Two-way relationships and prevailing expectations

One difficulty in attempting to understand how the economy works is that the relationships are often reciprocal. Is it policy that influences economic development or is there a reverse causal relationship? One reason for this ambiguity is that both private and public agents actively look ahead. The expectations of the private sector regarding future policy affect today’s decisions about wages, prices and investments, while economic-policy decisions are guided by expectations about developments in the private sector.

A clear-cut example of a two-way relationship is the economic development in the early 1980s, when many countries shifted their policy in order to combat inflation. This change was primarily a reaction to economic events during the 1970s, when the inflation rate increased due to higher oil prices and lower productivity growth. Consequently, it is difficult to determine whether the subsequent changes in the economy depended on the policy shift or on underlying factors beyond the control of monetary and fiscal policy which, in turn, gave rise to a different policy. One way of studying the effects of economic policy would be to carry out controlled experiments. In practice, however, varying policies cannot be randomly assigned to different countries. Macroeconomic research is therefore obliged to use historical data. The laureates’ foremost contribution has been to show that causal macroeconomic relationships can indeed be analyzed using historical data, even in cases with two-way relationships.

There are good reasons to believe that unexpected shifts in economic policy may have other effects than anticipated changes. It is not trivial, however, to distinguish between the outcomes of expected and unexpected policy. A change in the interest rate or tax rate is not the same as a shock, in the sense that at least part of the change might be expected. This is a longstanding insight in the context of the stock market. A firm which reports improved earnings and higher forecasted profits might still encounter a drop in its share price, simply because the market expected an even stronger report. Moreover, the effects of an unanticipated policy shift might depend on whether it was implemented independently of other shocks in the economy or was a reaction to them.

Sargent’s awarded research concerns methods that utilize historical data to understand how systematic changes in economic policy affect the economy over time. Sims’s awarded research instead focuses on distinguishing between unexpected changes in variables, such as the price of oil or the interest rate, and expected changes, in order to trace their effects on important macroeconomic variables. The questions which the laureates have dealt with are obviously interrelated. Although Sargent and Sims have carried out their research independently, their contributions are complementary in many ways.

Sargent: systematic effects of economic policy

What happens in the macroeconomy when monetary policy systematically follows a Taylor rule, i.e., when the interest rate responds to changes in inflation and the business cycle in a pre-determined pattern? Or what happens if a central bank is instead given a mandate to maintain inflation close to two percent? Sargent’s analysis deals with the effects of such systematic policy rules and the consequences of changes in the rules for policy. Expectations are an integral part of this analytical approach.

Is it possible to determine whether changes in the economy depend on shifts in economic policy? Could such changes instead depend on fluctuations in the overall economy that prompt decision-makers to adopt a different policy? Sargent has examined these issues using a three-step method.

His first step involves developing a structural macroeconomic model, i.e., an accurate mathematical description of the economy. A number of parameters, which determine the relationships among different variables, are introduced into the model. For instance, if we know that consumers’ aggregate demand for goods and services is affected by the expected real interest rate, this relationship should be incorporated in the model. The parameters governing such basic relations should not be affected by the changes in economic policy. This includes preference parameters, which describe how individuals choose between saving and consumption depending on interest rates and income.

The second step consists of solving the mathematical model. Sargent’s method focuses on expectations as to how macroeconomic variables will change. For example, are expectations about inflation in the future affected by changes in economic policy? A reasonable prerequisite for solving the model is that individuals’ inflation expectations in the model correspond to the forecasted inflation generated by the model itself. Imposing such a requirement is easier said than done, however, and the second step in Sargent’s analysis demonstrates how a solution may be found.

The third and last step is entirely statistical. Historical data are used to estimate the fundamental parameters that do not change after a policy shift. To simplify, this implies that parameter values are chosen so that the model will describe historical events as well as possible. In this way, numerical values are obtained for the parameters which describe the economic structure. The complete model can than be used as a “laboratory” to study the effects of different hypothetical experiments, such as a shift in monetary policy.

In a series of articles written during the 1970s, Sargent showed how structural macroeconomic models could be constructed, solved and estimated. His approach has turned out to be particularly useful in the analysis of economic policy, but is also used in other areas of macroeconometric and economic research.

Some of Sargent’s contributions were solely methodological, although he has also applied the new methods in highly influential empirical research. For instance, he has analyzed historical episodes of hyperinflation in different European countries. He has also examined the above-mentioned course of events in the 1970s when many economies initially adopted a high-inflation policy and then reverted to a lower rate of inflation. Sargent showed that the way expectations are formed by the general public as well as central banks’ understanding of the inflation process were based on gradual learning. This could explain why the decline in inflation took such a long time.

Sims: identification and analysis of macroeconomic shocks

Sims shared Sargent’s criticism of the large macroeconometric models which were earlier used by researchers, central banks and ministries of finance. In his article “Macroeconomics and Reality” (1980), Sims introduced a new way of analyzing macroeconomic data. He also concurred with Sargent in emphasizing the importance of expectations. Sims proposed a new method of identifying and interpreting economic shocks in historical data and of analyzing how such shocks are gradually transmitted to different macroeconomic variables. His approach has had an enormous impact on research. It has also been used extensively as a basis for decision-making in economic policy. Sims’s methodology may also be described in three steps.

In the first step, the analyst makes a forecast for macroeconomic variables using a vector-autoregression model (a VAR model). This is a relatively simple model for statistical time series, where previously observed values of the variables of interest are used to achieve the best possible forecast. The difference between forecast and outcome – the forecasting error – for a specific variable may be regarded as a type of shock, but Sims showed that such forecasting errors do not have an unambiguous economic interpretation. For instance, either an unexpected change in the interest rate could be a reaction to other simultaneous shocks to, say, unemployment or inflation, or the interest-rate change might have taken place independently of other shocks. This kind of independent change is called a fundamental shock.

The second step involves extracting the fundamental shocks to which the economy has been exposed. This is a prerequisite for studying the effects of, for example, an independent interest-rate change on the economy. Indeed, one of Sims’s major contributions was to clarify how identification of fundamental shocks can be carried out on the basis of a comprehensive understanding of how the economy works. Sims and subsequent researchers have developed different methods of identifying fundamental shocks in VAR models.

Once the fundamental shocks are identified based on historical data, the third step in Sims’s method is an impulse-responseanalysis. This illustrates the impact over time of the fundamental shocks to the macroeconomic variables.

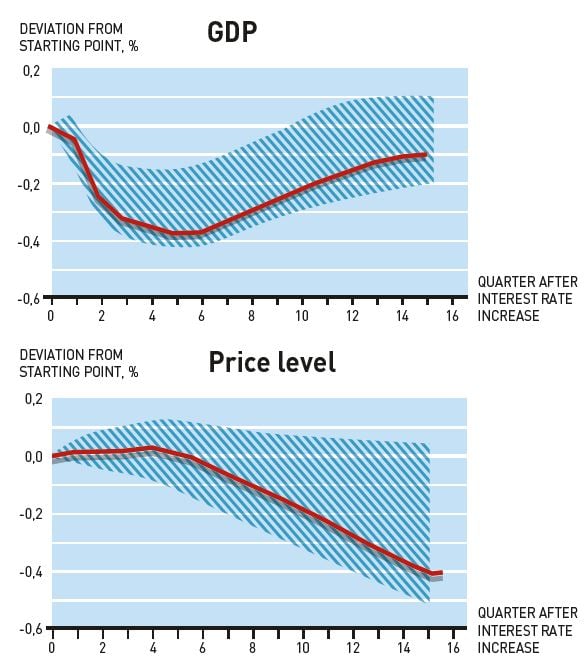

The figures below show how an impulse in the form of an increase in the interest rate set by the central bank leads to responses in macroeconomic variables with different time profiles. The graphs are based on a VAR analysis of U.S. postwar data (Christiano, Eichenbaum and Evans, 1999), where the shocks have been indentified using a method proposed by Sims.

The example shows the responses of two variables in the VAR model, GDP and the price level. GDP falls continuously for several quarters following the interest rate increase and does not turn upwards until after six quarters. The price level, on the other hand, is hardly affected at all until after six quarters, when prices start to fall – the rate of inflation goes down.

Impulse-response analysis has improved our understanding of the dynamic properties of the macroeconomy and has thereby affected the conduct of monetary policy. It is now common for central banks with an inflation target to adjust the interest rate in order to reach its goal over a horizon of one to two years, i.e., the time lag indicated by the figure. The graphs also illustrate that a contractionary monetary policy faces a trade-off between lower inflation after one to two years and an immediate reduction in GDP. Analogous VAR analyses of fiscal policy have shown how increased public spending may counteract a temporary dip in the business cycle. Today, VAR models are indispensable tools for central banks and finance ministries in their analyses of the impact of various shocks on the economy and of how the economy is affected by different policy measures.

Empirical macroeconomic research today

Sargent’s analysis of macroeconomic time series based on historical data opened up a rich field for macroeconomic research and has led to new insights about the workings of economic policy. Sims research, starting somewhat later, has also had an extraordinary influence, both in macroeconomics and other fields of research. Today, the directions of research that were inspired by Sargent’s and Sims’s contributions have much in common. In modern research, the solution to models developed using Sargent’s methods are often expressed in the form of a VAR system and evaluated by impulse-response analysis.

The empirical strategies proposed by Sargent and Sims are intercomparable. In order to study the impact of systematic policy changes on the economy, Sargent’s method requires specific assumptions about the structure of the economy – assumptions that may be questionable. The assumptions underlying a VAR model, on the other hand, are more general and hold across a wide class of economic models. Researchers have a choice of method depending on the application. With detailed knowledge about the structure of the economy, Sargent’s method may be preferable, in particular since it allows a counterfactual analysis of systematic changes in economic policy. When knowledge of the field is less exact, Sims’s method may be safer.

Owing to the scientific contributions of Sargent and Sims, research in macroeconomics and analysis of economic policy have advanced substantially. Their combined work constitutes a solid foundation for modern macroeconomic analysis. It is hard to envisage today’s research without this foundation.

Links and further reading

Interviews

Evans G.W. and Honkapohja S. (2005) An Interview with Thomas Sargent, Macroeconomic Dynamics, 9, 561–583. https://files.nyu.edu/ts43/public/research/SargentinterviewMD.pdf

Hansen, L.P. (2004) An Interview with Christopher A. Sims, Macroeconomic Dynamics, 8, 273–294.

Rolnick, A.J. (2010) Interview with Thomas Sargent, The Region, Vol. 24, No 3.

www.minneapolisfed.org/publications_papers/pub_display.cfm?id=4526

Rolnick, A.J. (2007) Interview with Christopher Sims, The Region, Vol. 21, No 2.

www.minneapolisfed.org/publications_papers/pub_display.cfm?id=3168

Lectures (video)

Sargent, T. J. (2010) Uncertainty and Ambiguity in American Fiscal and Monetary Policies, Old Theatre, London.

www.youtube.com/watch?v=ofhaWMF1r6Q

Sims, C. A. (2010) How Empirical Evidence Does or Does not Influence Economic Thinking and Theory: Calibration, Statistical Interference and Structural Change, The Institute for New Economic Thinking.

http://ineteconomics.org/video/conference-kings/empirical-evidence-christopher-sims

Review articles

Fernández-Villaverde, Jesús and Juan F. Rubio-Ramírez (2010) Structural vector autoregressions, The New Palgrave Dictionary of Economics, 2nd Edition, Eds. S.N. Durlauf and L.E. Blume, Palgrave Macmillan.

Piazzesi, Monika (2008) Rational expectations models, estimation of, The New Palgrave Dictionary of Eco- nomics, 2nd Edition, Eds. S.N. Durlauf and L.E. Blume, Palgrave Macmillan.

Sargent, T. J. (2008) Rational expectations, The New Palgrave Dictionary of Economics, 2nd Edition, Eds. S.N. Durlauf and L.E. Blume, Palgrave Macmillan.

Zha, Tao (2008) Vector autoregressions, The New Palgrave Dictionary of Economics, 2nd Edition, Eds. S.N. Durlauf and L.E. Blume, Palgrave Macmillan.

The Laureates

THOMAS J. SARGENT

U.S. citizen. Born 1943 in Pasadena, CA, USA. Ph.D. 1968 from Harvard University, Cambridge, MA, USA. William R. Berkley Professor of Economics and Business at New York University, New York, NY, USA

http://econ-www.mit.edu/faculty/pdiamond

CHRISTOPHER A. SIMS

U.S. citizen. Born 1942 in Washington, DC, USA. Ph.D. 1968 from Harvard University, Cambridge, MA, USA. Harold H. Helm ’20 Professor of Economics and Banking at Princeton University, Princeton, NJ, USA.

www.princeton.edu/~sims/

© The Royal Swedish Academy of Sciences

Nobel Prizes and laureates

Six prizes were awarded for achievements that have conferred the greatest benefit to humankind. The 12 laureates' work and discoveries range from proteins' structures and machine learning to fighting for a world free of nuclear weapons.

See them all presented here.