Paul R. Milgrom

Biographical

Iwas born in 1948 in Detroit, Michigan to Abraham Isaac Milgrom and Anne Lillian Milgrom nee Finkelstein. Abraham Milgrom was born in Canada to Polish-Jewish immigrants, and Anne Finkelstein in Detroit, Michigan, to Ukrainian-Jewish immigrants. I am the second of the Milgroms’ four sons; Stuart is my older brother and Barry and Steven are my younger twin brothers. We grew up in Oak Park – a suburb of Detroit – where I attended the John Dewey School followed by Oak Park High School, from which I graduated in 1966.

From a young age, I had a strong interest in math, encouraged by my middle and high school math teacher Mr. Habermas. He also encouraged me to apply to the Ross summer math camp at Ohio State University in 1965, where I was #1 in my class. In high school, I took joy and interest in solving math puzzles, playing chess, and participating in various youth groups in the local Jewish community.

After high school, I attended the University of Michigan in Ann Arbor but was bored by my non-major classes and earned unimpressive grades. Initially choosing between a math and a physics major, I dropped my first physics class because of its 8 A.M. time-slot far across campus during a freezing cold Michigan winter. I remember climbing out of bed, opening the door to the sub-zero temperatures, and then turning around and going back to bed. I graduated from the University of Michigan in 1970 with an AB in mathematics and then followed a girl to Berkeley, California, landing my first job as an actuarial trainee at Metropolitan Life Insurance Company in San Francisco. After about a year, I quit San Francisco and returned to Ann Arbor to stay with friends and study for the actuarial exams, before moving to Columbus, Ohio to join the Nelson and Warren actuarial consultancy. In Columbus, I first discovered my inclination to do theoretical research on practical problems. I published two prize-winning theory papers in the Transactions of the Society of Actuaries. It was also in Columbus at a friend’s house party that I met Jan Thurston, whom I later married. We lived in the German Village section of Columbus for about a year before moving to Stanford University in 1975, where I planned to pursue an MBA and broaden my understanding of business.

In the MBA program, I took an advanced methods class from Evan Porteus, who wondered about the rate at which some approximation would converge to the true value. When I explained that it depended on the subdominant eigenvalue of the Markov matrix, Porteus encouraged me to quit the MBA program and pursue a Ph.D. instead. It was excellent advice, and I took it.

Unsure about what to do next, I asked an advanced graduate student, Bengt Holmström, who told me: “The secret is to get Bob Wilson to be your dissertation adviser.” So, I signed up for Wilson’s class in “Multi-person Decision Theory,” which involved reading new research in economic theory. The readings included one paper of Wilson’s, about auctions. Hoping to get Wilson’s attention, I wrote a term paper extending Wilson’s work. He was excited by the results, telling me that the paper could be the main chapter of my doctoral dissertation.

Holmström became a lifelong friend, colleague, and co-author, as well as a Laureate in economic sciences in 2012. Wilson, now a friend and neighbor, became my co-Laureate in 2020.

Finishing my dissertation in 1978, I stayed at Stanford so that my first child, Joshua, would be born there in December. My Ph.D. degree was awarded in 1979, celebrating with Joshua on my shoulders. I moved my family to our new home in Evanston, Illinois when Joshua was just a few days old. Joshua would go on to have a son of his own, Shepherd Prem Thurston-Milgrom. Of being a grandfather, I can only offer the oft-repeated quip: “if I’d known how much fun a grandchild could be, I would have had him first!”

Figure 1. Baby Joshua holding my Stanford doctoral diploma.

I took my first academic job at the Kellogg School of Management at Northwestern University, where I met yet another future Laureate, Roger Myerson. I also recruited my old classmate Bengt Holmstrom to join me there. The three of us challenged one another every day, inspiring each other to do better, deeper work. We lunched and socialized together, becoming life-long colleagues and friends. I also met my two most frequent coauthors there: Robert Weber and John Roberts.

Figure 2. Bengt, Roger, and me celebrating Holmström’s prize in my home.

The group at Northwestern was intent on bringing game theory with incomplete information into the center of economics. That was a controversial endeavor. When John Roberts (1982a) and I wrote a paper to explain limit pricing – the practice of setting low prices to discourage entry by a competing firm – our explanation was that the incumbent firm was trying to convince any potential entrant to expect fierce competition. Critics raised a howl of resistance. Scientific modeling of industrial competition, they insisted, must explain outcomes based on the measurable conditions of supply and demand and barriers to entry, and not on factors like the parties’ beliefs or how those could be influenced! We were undeterred. Milgrom and Roberts (1982b) and Kreps and Wilson (1982) similarly explained predatory pricing as discouraging future entrants by influencing their beliefs, making them anticipate that entry would lead to sharp price reductions.

Maybe its worth adding the reference to this paper – it is also missing from the reference list at the end – in which players play against one another perhaps twenty or thirty times – in a similar way. According to the traditional Nash equilibrium analysis, players in that game will never cooperate, but experimental evidence rejects that prediction. Human players nearly always manage to cooperate until near the end of the game. Our theory worked differently. If cooperation and reciprocal behavior can encourage others to expect more of the same, then there is nothing puzzling about cooperation. Criticism of our approach eventually gave way to praise. The National Academy of Sciences highlighted these papers in announcing the Carty Prize for Advancement of Science in 2018. Our work had created powerful new tools allowing game theory to analyze economic institutions and human behavior.

However, it was my research in auction theory and my discovery of new auction designs that the Prize Committee named in the prize citation. My auction-related research evolved through three distinct eras. In the first, which began with my Stanford dissertation under Wilson’s mentorship and continued for about five years, I extended Wilson’s research program, mostly in joint work with Robert Weber. Our best-known paper (Milgrom and Weber, 1982) characterized the equilibrium strategies of auction games and studied the extent to which bidders’ private information became reflected in prices in auctions and securities markets and how a seller’s expected revenue depended on the auction rules. The second era, beginning around 1993, was launched when Congress authorized the FCC to sell radio spectrum rights using an auction. The FCC order establishing and justifying the auction rules cited me by name more than 100 times and adopted virtually all of Wilson’s and my proposals.

Despite the praise the auction had received, I worried that the rules were not well-enough grounded in economics and game theory. Like others at the time, I had based my analyses on the assumptions that the items for sale were substitutes and optimization was tractable. The third era, which began around 2001, relaxes those assumptions. In this era, the teams I led aimed to solve practical problems, which sometimes required solving research problems in computer science, economics, and game theory.

The first era

When I began my economics research career under the tutelage of co-laureate Robert Wilson, game theory had just started to penetrate economics. General equilibrium theory, which was then dominant, assumed that market-clearing prices guided allocations. It had little to say about the price discovery process. Wilson suggested that auctions, with their explicit rules and long history in practice, could be studied by game-theoretic methods to understand how prices and allocations emerge together.

Much of the early research in the Wilson tradition focused on the information content of prices. How much of the bidders’ information comes to be reflected in the prices that are paid? To what extent can bidders profit by using their private information? Do some auction rules lead to systematically higher expected prices than others?

That information problem took on a special urgency following the publication of an influential paper by Grossman and Stiglitz (1980), in which investors with private information about values traded in a market. To incorporate effects like the winner’s curse, Grossman and Stiglitz adopted a general equilibrium model. Their twist was that traders’ demands would be based on inferences from the market-clearing price about others’ information. But how could that information become embedded in prices even before anyone had committed to a trade? In their simplest model, asset prices make it possible to infer all information available to all traders in the market. Consequently, even the best-informed traders cannot profit from trading, so nobody has any incentive to acquire information. But if nobody acquires information, then presumably prices must be uninformative, so any trader who acquires private information should be able to earn a profit in equilibrium. This was the Grossman-Stiglitz information paradox. It confirms that one cannot adequately study the information content of prices without looking directly at the trading mechanism’s detailed rules.

Even before Grossman and Stiglitz, Wilson (1977) had introduced such a model. It was a “common values” auction model with a single asset for sale with equal value to all bidders. There is no information paradox in that model. Bidders invest in information because better-informed bidders earn more profits in the auction. Prices reflect private information because they depend on the bids that informed investors make. Although Wilson’s analysis also highlighted the “winner’s curse,” which is the tendency of a bidder to win more often when his estimate is too high than when it is too low, Wilson’s main point was different. The paper first derived the Nash equilibrium of the bidding game. It then showed that when a particular condition is satisfied, the equilibrium auction price converges in probability to the common value as the number of bidders grows large. This convergence means that the price “aggregates” information because it holds even when no individual bidder has a tight estimate of the value when it submits its bid.

My first published economics paper (Milgrom, 1979) was my term paper for Wilson’s class. It extended the just-described analysis to identify a necessary and sufficient condition for that convergence-in-probability to occur − the mathematical analysis that impressed Wilson. I used a statistical argument to show that my condition is necessary for convergence, regardless of the bidding strategies, and a game-theoretic argument to prove that the same condition is sufficient when bidders use their equilibrium strategies.

The year 1982 was an especially productive one for me. With various coauthors, I wrote papers about auction theory, game theory, industrial organization, and the famous “No Trade Theorem.” The Milgrom-Stokey No-Trade Theorem model extended my earlier auction models to focus on security trading when both buyers and sellers can suffer a winner’s curse. The agents were risk averse, with strictly concave utility functions, and could have private information about the security values and their pretrade security holdings. Each agent trades only if that increases its expected utility conditional on its information. The information includes the trader’s own information and the fact that the market clears, that is, the remaining traders are willing to take the other side of the trade. We concluded that: “Risk averse traders never make (non-zero) trades based solely on differences in information.” Thus, for trade to occur among rational traders, there must be at least the possibility that, if there were no differences in information among traders, some Pareto-improving trade might exist. In other words, it must be possible that someone has a transactional motive for trading and not just a speculative motive. Typical examples of a transactional motive in real life include an agent wanting to buy securities because she has just added monthly savings to her retirement account or sell securities to pay this year’s tuition bill at some school or college.

In 1981, just two-and-a-half years after receiving my doctorate, I accepted an offer from Yale University to occupy the Williams Brothers chair, with tenure. It was a joint appointment between the new Yale School of Management and the Department of Economics. I moved my family to New Haven in 1982. In that same year, Jan and I had our second child, Elana Suzanne Thurston-Milgrom, delivered at Yale-New Haven Hospital.

Having a daughter changed my life! Growing up a shy boy with only brothers, Elana taught me about girls and later young women. Later, watching her sexist treatment during her graduate studies at the University of Florida, I was inspired to focus on training women economists at Stanford.

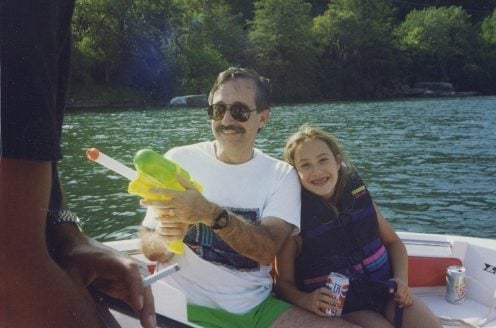

Figure 3. Elana and me on Preston MCAfee’s boat, while visiting him in Texas.

Arriving at Yale, I again recruited Bengt Holmstrom to join me. We wrote a series of papers together. The best-known one was our multitask principal-agent theory, which highlights the danger of explicit incentives. Providing incentives for a valuable task that is easily measured may lead an agent to substitute valuable effort away from other, unmeasured tasks. For example, rewarding teachers for improving student test scores might backfire by encouraging the teacher to shift effort away from social development and creative thinking. That is why culture, professionalism, and loyalty are so essential to motivate workers in many jobs.

During my years at Yale, I continued my work situating incomplete-information game theory in the center of economic theory. In one of my bestknown papers, which Larry Glosten and I (1985) began during my Northwestern years, we continued the Milgrom-Stokey study of trading with private information on both sides and the Wilson theme of how much information would be reflected in the prices. In our model, there is a single financial security to be traded. Each trader may have any mix of transaction and speculative motives for trading. A group of risk-neutral “specialists” is present in the market, competing against one another to buy from or sell to each arriving customer. The specialists set bid prices, at which they offer to buy, and ask prices, at which they offer to sell. The customer sees all the bids and asks and takes the best deal if any are acceptable or walks away without trading. Price competition among the specialists for each transaction drives their expected profits to zero on each.

One conclusion of this model is the so-called “weak form” of Fama’s (1970) efficient markets hypothesis: transaction prices are equal to the expected value of the security to the specialists at the time of any trade, conditional on the available public information. If the trader buys, then the market price will be the expected value conditional on the trader choosing to buy. Similarly, if the trader chooses to sell, the market price will be the expected value conditional on the trader choosing to sell. In this way, the transaction price includes some of the trader’s information, but not all of it. It resolves the Grossman-Stiglitz information paradox because a trader who acquires more information makes better decisions and earns higher profits. This paper, along with a contemporaneous one by Kyle (1985), launched the modern literature on financial market microstructure, which examines the detailed rules of trading and how those affect various measures of market performance.

Another set of questions that had attracted economists’ attention in the first era of auction research concerned how bidders’ payoffs and the seller’s expected revenue depended on the auction rules. When I began my work, there were two main game-theoretic models for studying auctions: the Vickrey model and the Wilson model. Working at Northwestern with a frequent collaborator, Robert Weber (Milgrom and Weber, 1982) I introduced a new auction model that subsumed the Vickrey and Wilson models. We also developed new methods to study bidder profits in an auction and provided answers to the payoff and revenue questions. We extended the earlier models by weakening the assumption of how types were distributed and allowing each bidder’s value to depend more generally on everyone’s information and some unknown parameters. In my 2004 book, I summarized the literature including the Milgrom-Weber analysis by deriving all of the revenue and payoff results using the envelope theorem. For the Milgrom-Weber analysis, this approach generalized older “revenue equivalence” results and also led to a new “linkage principle,” which establishes certain inequalities relating to bidder payoffs and seller revenues in different auction designs.

After five years at Yale and a half-year visit to UC Berkeley in 1986, I received an offer to teach at my alma mater. I relocated my family to Stanford in 1987.

From the mid-1980s to the early 1990s, I moved away from working on auctions. I focused on game theory, robust methods for comparative statics, principal-agent theory, and economic organization theory with co-authors Roberts, Weber, Holmstrom, and Drew Fudenberg. Roberts and I wrote our book, Economics, Organization and Management, which helped define the scope of the field. Holmstrom and I wrote the first continuous-time principal-agent model and used it to create our multi-task analysis and our theory of firms as a system of incentives. With Douglas North and Barry Weingast (1990) and with Avner Greif and Barry Weingast (1994), I pioneered the use of game-theoretic models to illuminate the role of trading institutions in economic history.

The second era

In 1993, when Congress authorized the FCC to auction the radio spectrum licenses, I grew interested in auction theory again. The first licenses to be auctioned would be for paging and mobile telephones. According to the law, the FCC’s goals were, first, to promote the efficient and intensive use of radio spectrum and, second, to capture a portion of the spectrum value for the US Treasury.

Many years earlier, Ronald Coase (1959) had advocated that the FCC should use an auction for assigning television broadcast licenses but had nothing to say about what the auction rules should be. Perhaps that seemed unimportant to him for the applications of the time. Licenses for TV broadcasting mostly support independent business opportunities, which could be reasonably sold one at a time using almost any standard auction method. If businesses bid against one another for license rights, then to a first approximation, the licenses would tend to be assigned to the bidder with the most valuable business plan, which (in the absence of externalities) could promote efficiency.

The situation in 1993, however, was quite different. Companies like AT&T, MCI and Sprint, which were then providers of long-distance telephone services supported by nationwide networks of fiber-optic cables, developed business plans based on nationwide wireless networks. They were not interested in buying isolated license rights in a collection of unconnected areas and lobbied to have the FCC offer nationwide licenses for mobile services with enough bandwidth to support a brand-new service. Local companies like Cincinnati Bell wanted to acquire just a local license with narrower bandwidth to supplement its existing cellular services and advocated that the FCC offer the corresponding licenses. Regional companies like Pacific Telesis and Bell Atlantic had existing regional cellular services and lobbied accordingly. Trying to be all things to all bidders, the FCC decided to offer 99 different licenses covering different areas with different amounts of bandwidth.

The FCC had never run an auction before, and nobody anywhere had attempted a sale of this complexity. From the perspective of 1993, Wilson and I identified the biggest challenge as one of “price discovery.” If bidders could learn the approximate prices before making their final bids, that would promote an approximately efficient market outcome. Most of the leading proposals, however, did not respect that challenge. For example, one proposal was to employ the same rules used by a traditional auction house like Sotheby’s, with each auction lot sold one-at-a-time in a

predetermined sequence. That approach would provide bidders with no useful information about the prices for licenses that will come up later. For example, if the first licenses offered covered Chicago and Los Angeles and if the bidder’s business plan required those plus licenses covering New York, Boston, and San Francisco, then how much should the bidder be willing to pay? The bidder faces several risks. One is the “exposure risk” that the bidder might succeed in buying the early licenses only to learn that the late licenses cost too much. Another is the “overpayment risk” that the buyer of the first Chicago license subsequently finds that a second Chicago license, offered later in the auction, is sold for a much lower price. These auction rules would require bidders to make many guesses, some of which would likely be mistaken. Those mistakes could undermine the main statutory goal of efficiency of the outcome.

With the exposure risk for the long-distance operators in mind, another proposal was to have licenses covering smaller areas but to allow bidders to offer a single price for specific packages of licenses, such as a package covering the whole country. There were howls of objections to that procedure as being too heavily biased in favor of nationwide bidders. It would force bidders for smaller areas to somehow coordinate their bids to compete against the highest national bidder without offering any mechanism to promote such coordination. Neither of these alternative proposals conceives of the issue as one of price discovery, as Wilson and I (and, separately, Preston McAfee) had done.

Questions about how to address the auction design challenge led both the FCC and several telephone companies to seek the advice of academic economists. Wilson and I were approached by Pacific Bell while the FCC hired Professor John McMillan. As I pondered the novel challenges of the spectrum allocation problem, I was reminded of my experience bidding in “silent” auctions at charity events. In a typical such event, people donate things to be sold in an auction. For example, one person might donate cooking lessons; a second person might donate an evening with a celebrity; a third, a weekend at a privately owned ski chalet; another, a bottle of wine, and so on. Items or their descriptions are placed on tables in a large room, and everything is for sale at once. There is a bidding form and a pencil in front of each item. Bidders would write their name or ID number and a price on the form, subject to the restriction that the bid must exceed the price on the preceding line by some minimum increment. A bidding deadline is set just before dinner or before another fund-raising activity, such as a live auction. The simultaneous ascending design allows a bidder who is unsure which item to bid on to begin with her most preferred items and then switch to others if the preferred items become too expensive. This process eases the bidder’s task of deciding which item to bid for and how much to bid.

I assessed that the silent auction design had worked well for the charities, but “snipers” often gamed the rules. Sniping is a strategy of waiting until the last moment to bid, hoping to keep the price low. By bidding only in the final seconds, a sniper can sometimes win by denying other bidders an opportunity to compete.

To retain the silent auction’s advantages while also eliminating sniping, Wilson and I proposed a new design: the simultaneous multiple round (SMR) auction. It differed in three ways from the silent auction.

First, it would be run in a series of discrete rounds. The FCC would set the minimum price for each item by adding a minimum increment to the best previous bid. Only after a round closes would information about bids from that round be shared among the bidders. Then, the next round would begin.

Second, the auction would not end until a round with no new bids for any license. This new termination rule would frustrate sniping, for if a sniper were to bid in a late round, there would always be another round allowing a willing competitor to raise the bid.

Third, since the auction had no fixed ending time and since any one bid could keep the auction alive, there was a risk that an auction of many licenses could take an untenably long time to finish. FCC staffer Evan Kwerel worried about that and challenged me to respond. I invented a new category of rule – the activity rule – which prevents any bidder from bidding for a larger quantity of licenses in any round than in any previous round. Activity rules similar to this one shorten auctions and are still standard features in modern auction design worldwide.

Critics alleged that the SMR was too novel to be reliable and too complicated for bidders to use. I countered those allegations by presenting Kwerel with a working SMR coded using Excel spreadsheets. Each bidder entered its bids on one spreadsheet, which included code to check that its bids satisfy the activity and eligibility rules and to inform the bidder if it violated either rule. The auctioneer had another spreadsheet, which imported bids for each round from the bidders’ spreadsheets, rechecked that the bids were legal, processed the bids, and output the round results. That proof was enough, leading Kwerel to recommend that the FCC adopt the Milgrom-Wilson design.

The initial auctions ran with no significant glitches. The design was welcomed by bidders, celebrated in the popular press, copied by several other countries, and declared a success by politicians and regulators. While the basic principles have remained largely unchanged, the rules continue to evolve from auction to auction. As I write these words, the “C band” auction has just finished, raising more than $80 billion for the US Treasury. Other auctions based on the SMR design raised hundreds of billions more in the US and other countries.

As successful as 1994 was for me professionally, 1995 was a personal disaster. My wife, Jan Thurston, suffered a brain injury that left her seriously disabled and with permanent personality changes. I spent the next year trying to salvage our marriage, but our relationship had changed too drastically. Instead of being my partner in caring for our two children as they struggled with the same family catastrophe, Jan had become an extra and difficult dependent. She will always be part of my family, but we could not remain married. Today, 25 years after her brain injury, we continue to have dinners together every Tuesday night, and I still manage her welfare and finances.

About a year after Jan’s injury, personal and professional changes began to happen. William Vickrey, the founder of modern auction theory, was selected to become a 1996 Laureate, but he died suddenly just after the prize announcement. Jean-Jacques Laffont and I were tapped to lecture in Stockholm to celebrate Vickrey and his life. At the Nobel Prize dinner in Stockholm, I was seated next to my future wife, Eva Meyersson, who charmed me from the start with her wit and laugh and tolerance for my awkward dancing. But there was a problem: she lived in Stockholm while I lived in California.

How does love overcome such a great distance? Home in California, thinking about Eva, I considered my next move. Any woman in Stockholm, I imagined, would be skeptical about starting a relationship with a California man and would likely be discouraged by her confidants, too, but a sufficiently grand gesture would be hard to dismiss. So, I wrote to Eva, “since you live in Stockholm and I live in Palo Alto, I’ll send you an airline ticket and meet you anywhere in the world.” That offer left some confidants speechless, but when Eva spoke to her grandmother, she got some sage advice. “Come back to Stockholm,” was Eva’s reply. So, I did.

Eva and I were married on September 17, 2000, on Eva’s 48th birthday. Eva and I traveled and had fun and visited Sweden often. In 2006, to celebrate our tenth meeting anniversary, the Nobel Foundation invited us back to Nobel celebrations and arranged a press conference for us, where I was to deliver the best single line of my life. On live TV, with Eva’s family and friends watching, I was asked how I felt that I had not won the Prize that year. I answered: “Oh, but I’m the one who went home with the biggest prize!”

Figure 4. Eva and me in Stockholm City Hall on our 10-year meeting anniversary.

My struggles in the mid-1990s led my research program to atrophy. As I emerged from my crisis, I restarted my research and teaching by narrowing my focus to study the challenges in designing spectrum auctions. Visiting Harvard and MIT in successive years, 2000 and 2001, I collaborated with Alvin Roth to introduce the first graduate class in Market Design. Al had recently helped redesign the residency matching program for doctors and our class sought to connect our experiences and launch a new subfield in economics.

I wrote a book and several research papers to mine the same rich vein. Milgrom (2000) proved the efficiency properties of the SMR auction when bidders bid straightforwardly, showing how the development of prices could promote an efficient outcome when the licenses are substitutes. My 2004 book explored bidders’ incentives to bid more strategically; John Hatfield and Milgrom (2005) connected auction algorithms like the SMR to the matching algorithms like the one doctors use for their residency match; Milgrom (2009) introduced a bidding language that can be used in a sealed-bid auction to replicate some of the advantages of the SMR auction; and Nick Arnosti, Marissa Beck and Milgrom (2016) derived a new auction format for internet display advertising that mitigates the winner’s curse. I also consulted to help companies and governments design auctions for radio spectrum licenses, electrical power, internet advertising, agricultural commodities, and more.

The third era

Despite the SMR design’s celebrated performance, I worried that its supporting theory relied on the strong and sometimes badly unrealistic assumption that licenses were substitutes. My doubts grew in 1995, when Australian regulators proposed auctioning licenses to thin slices of spectrum covering tiny geographic areas (“postage stamps”). They had reasoned that phone companies could assemble combinations of postage-stamp licenses to fit any business plan. If the SMR could be counted on to reveal market-clearing prices before bidders made their final decisions, that would promote an efficient outcome. In actual auctions, however, it had become clear that the SMR was just a partial solution to the price discovery problem. There were two reasons. First, as I proved in my 2004 book, there might not be any market clearing prices if licenses are not substitutes. Second, in actual SMR auctions, bidding for more valuable licenses typically ends earlier than for less valuable ones. Even in an SMR, a bidder could still wind up acquiring too small a set of licenses to operate a viable business. Because the postage stamp licenses in the Australian proposal were far too small individually to support a viable business plan, they could sometimes be complements – the opposite of substitutes – creating an exposure problem.

This concern gave new urgency to re-evaluating the idea from the first FCC auction that bidders could submit bids on any package of licenses that make sense, with each bid winning either the entire package or nothing. Package auctions, however, raise difficult new problems. One is that there are too many packages for bidders to evaluate without the guiding information of gradually revealed prices. For example, in FCC auction #66, with 1,400 items offered, the number of packages is 21400, which is more than 10421 – far too many for any bidder to list. Computing winning package bids is NP-hard, which means it can be too challenging even for a fast computer in such a large-scale auction. Vickrey pricing rules could provide incentives to bid truthfully in a package auction, but Lawrence Ausubel and Milgrom (2005a) identified a long list of other problems with that auction design.

My work to improve combinatorial design included sealed bid designs in Ausubel and Milgrom (2002a, 2002b, 2005b) and Robert Day and Milgrom (2008, 2013) and the dynamic “combinatorial clock auction” of Ausubel, Peter Cramton and Milgrom (2005), which has become the next most common spectrum auction family after the SMR family of designs. John Kagel, Yuanchuan Lien and I (2010, 2014) report lab experiments to evaluate how certain complex combinatorial designs perform in practice, at least when the bidders are students of the kind who are subjects in these experiments. Jeremy Bulow, Jonathan Levin, and I (2017) report on the exposure problem in the SMR from the perspective of a bidder that we advised.

My greatest auction design challenge, however, was yet to come. In 2012, as part of the US stimulus legislation, the FCC was required to conduct an auction to buy television broadcast rights, relocate the remaining broadcasters into a smaller set of channels, and sell mobile broadband rights to willing buyers. The idea had been proposed by Kwerel and John Williams and the auction problem it created was the most complicated one in history. The FCC asked me to assemble a team through my company, Auctionomics, to design and create software for the auction. Two new auction problems were the most challenging ones.

First, given a number of channels to clear, how would the procurement auction work to buy enough broadcast rights to make that possible? The question of whether it is possible to pack a given set of stations on a given set of channels is in a computer science complexity class called “NP-complete.” For such questions, using even the fastest known algorithms, the time to solve a problem cannot be guaranteed to be less than an exponential function of the problem size. Our problems had more than a million constraints and the auction to select a winning combination needs to solve thousands of such problems, so the auction would have to work well even when the packing problems are sometimes unsolved. I hired Kevin Leyton-Brown to develop customized algorithms that worked for most of the problems we encountered and another collaborator, Ilya Segal, to help devise auction rules that would work well even when the algorithm failed to solve some packing problems.

Second was the question of how many channels to clear. In a standard market with buyers and sellers, that is solved by finding a price at which the numbers of goods demanded and supplied are equal. But television broadcasters and broadband providers cannot just be counted on to find the clearing price. Each TV station operates from a distinct location and power that distinguishes it from every other station. Different broadband licenses similarly serve different areas and populations. To accommodate this heterogeneity, the auction would need thousands of different prices.

The technical solutions to these auction design problems were worked out between 2011 and 2015. The details of those were reported in Milgrom and Ilya Segal (2017, 2020) and Leyton-Brown, Milgrom and Segal (2017).

In 2020, in recognition of “improvements to auction theory and creation of new auction designs,” Bob Wilson and I were awarded the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel.

Figure 5. Bob Wilson and me in my Stanford backyard, at our unusual – COVID safe – Nobel celebration.

© Nobel Prize Outreach. Photo: Elena Zhukova

© Nobel Prize Outreach. Photo: Elena Zhukova

I have continued to publish new research but now dedicate more of my time and effort to training students. Reflecting on the historic accomplishments of my friends and collaborators and the exceptionally fine scholars who surround me now, I am optimistic about the future. As Tennyson wrote in his poem Ulysses: “Some work of noble note may yet be done, not unbecoming men that strove with Gods.”

Bibliography

Arnosti, N., Beck, M., and Milgrom, P. (2016). Adverse selection and auction design for internet display advertising. American Economic Review, 106(10), 2852–66.

Ausubel, L. M., and Milgrom, P. (2006). The lovely but lonely Vickrey auction. Combinatorial auctions, 17, 22–26.

Ausubel, L. M., Cramton, P., and Milgrom, P. (2006). The clock-proxy auction: A practical combinatorial auction design. Handbook of Spectrum Auction Design, 120–140.

Bichler, M., Milgrom, P., and Schwarz, G. (2020). Taming the Communication and Computation Complexity of Combinatorial Auctions: The FUEL Bid Language.

Bulow, J., Levin, J., and Milgrom, P. (2017). Winning play in spectrum auctions. Handbook of spectrum auction design. Cambridge University Press.

Coase, R. H. (1959). The federal communications commission. The Journal of Law and Economics, 2, 1–40.

Day, R., and Milgrom, P. (2008). Core-selecting package auctions. International Journal of Game Theory, 36(3–4), 393–407.

Day, B., and Milgrom, P. (2013). Optimal incentives in core-selecting auctions. Handbook of Market Design. OUP Oxford.

Fama, E. F. (1970). Efficient capital markets: A review of theory and empirical work. The journal of Finance, 25(2), 383–417.

Gale, D., and Shapley, L. S. (1962). College admissions and the stability of marriage. The American Mathematical Monthly, 69(1), 9–15.

Glosten, L. R., and Milgrom, P. R. (1985). Bid, ask and transaction prices in a specialist market with heterogeneously informed traders. Journal of financial economics, 14(1), 71–100.

Greif, A., P. Milgrom and B. Weingast (1994). Coordination, commitment and enforcement: the case of the merchant guild. Journal of Political Economy, 102(3), 745–776.

Grossman, S. J., and Stiglitz, J. E. (1980). On the impossibility of informationally efficient markets. The American economic review, 70(3), 393–408.

Hatfield, J. W., and Milgrom, P. R. (2005). Matching with contracts. American Economic Review, 95(4), 913–935.

Kagel, J. H., Lien, Y., and Milgrom, P. (2010). Ascending prices and package bidding: A theoretical and experimental analysis. American Economic Journal: Microeconomics, 2(3), 160–85.

Kyle, A. S. (1985). Continuous auctions and insider trading. Econometrica, 1315–1335.

Kagel, J. H., Lien, Y., and Milgrom, P. (2014). Ascending prices and package bidding: Further experimental analysis. Games and economic behavior, 85, 210–231.

Kelso Jr, A. S., and Crawford, V. P. (1982). Job matching, coalition formation, and gross substitutes. Econometrica, 1483–1504.

Kreps, D. and R. Wilson (1982). Reputation and imperfect information. Journal of Economic Theory, 27(2), 253–279.

Leyton-Brown, K., Milgrom, P., and Segal, I. (2017). Economics and computer science of a radio spectrum reallocation. Proceedings of the National Academy of Sciences, 114(28), 7202–7209.

Li, Shengwu (2017). Obviously strategy-proof mechanisms. American Economic Review, 107(11), 3257–3287.

Newman, N., Leyton-Brown, K., Milgrom, P., and Segal, I. (2020). Incentive Auction Design Alternatives: A Simulation Study.

Milgrom, P. R. (1979). A convergence theorem for competitive bidding with differential information. Econometrica, 679–688.

Milgrom, P. (2000). Putting auction theory to work: The simultaneous ascending auction. Journal of political economy, 108(2), 245–272.

Milgrom, P. (2004). Putting auction theory to work. Cambridge University Press. Milgrom, P and Eilat, A. (2011). The CAF auction: Design proposal. WC Docket, (10–90).

Milgrom, P. (2009). Assignment messages and exchanges. American Economic Journal: Microeconomics, 1(2), 95–113.

Milgrom, P., D. North and B. Weingast (1990). The role of institutions in the revival of trade: the medieval law merchant. Economics and Politics, 2, 1–23.

Milgrom, P., and D.J. Roberts (1982). Predation, reputation and entry deterrence. Journal of Economic Theory, 27(2), 280–312.

Milgrom, P. and D.J. Roberts (1992). Economics, Organization and Management. New York: Pearson.

Milgrom, P. and Segal, I. (2002). Envelope theorems for arbitrary choice sets. Econometrica, 70(2), 583–601.

Milgrom, P. and Segal, I. (2020). Clock auctions and radio spectrum reallocation. Journal of Political Economy, 128(1), 1–31.

Milgrom, P., and Stokey, N. (1982). Information, trade and common knowledge. Journal of economic theory, 26(1), 17–27.

Milgrom, P. R., and Weber, R. J. (1982). A theory of auctions and competitive bidding. Econometrica, 1089–1122.

Myerson, R. B. (1981). Optimal auction design. Mathematics of operations research, 6(1), 58–73.

Ortega-Reichert, A. (1968). Models for competitive bidding under uncertainty.

Vickrey, W. (1961). Counterspeculation, auctions, and competitive sealed tenders. The Journal of finance, 16(1), 8–37.

Vickrey, W. (1962). Auctions and bidding games. Recent advances in game theory, 29, 15–27.

Wilson, R. (1977). A bidding model of perfect competition. The Review of Economic Studies, 44(3), 511–518.

Wilson, R. (1979). Auctions of shares. The Quarterly Journal of Economics, 675–689.

Copyright © The Nobel Foundation 2021

Nobel Prizes and laureates

See them all presented here.