Richard H. Thaler

Biographical

1.Early days

1.Early days

I was born in East Orange, New Jersey, on September 12, 1945. My father, Alan, was an actuary for Prudential Life Insurance, where he would spend most of his career. He had graduated from the University of Toronto, majoring in math and physics. Alas, I did not inherit his mathematical prowess. My mother Roslyn attended the now defunct Upsala College in East Orange. She was an elementary school teacher before having children: myself and my younger brothers, Donald and Maurice. Aside from a two-year stint in Los Angeles, where my father was temporarily transferred, I spent my youth in New Jersey. We lived in Chatham after returning from California.

My career as a student was undistinguished. A combination of mild dyslexia, a habit of daydreaming, and a dislike for tedious work were all contributing factors. My father was always frustrated with what he considered to be my carelessness. I remember an episode in Chatham when I was young, I am guessing around age eight, when my father attempted to teach me discipline. He instructed me to copy the first two pages of Mark Twain’s book, Tom Sawyer, verbatim. When I did it perfectly I would be allowed to go out and play with my friends. Although this seems to be an easy enough task I never quite got it right. In my defense, the opening does have a lot of dialogue with punctuation I could never quite get perfectly.

“TOM!”

No answer.

“TOM!”

No answer.

“What’s gone with that boy, I wonder? You TOM!”

After several days filled with much yelling and frustration by both of us, my father finally gave up on this task.

When I was finishing middle school my parents decided that the answer to my scholastic problems was to attend a more rigorous school, so they sent me off to Newark Academy, a private day school for boys then located in Newark. (It moved to Livingston shortly after I graduated.) I commuted to school on the train along with many men in suits, including my father. The plan of sending me to a harder school worked to some extent. I did work harder, and got lots of practice writing, but the same limitations kept me from being a top student.

For college I went to Case-Western Reserve University in Cleveland. There I met my first wife, Dianne (“Dee”) Shiff, with whom I had three children: Greg, Maggie and Jessie. My favorite subjects at college were economics and psychology and I decided to go to graduate school in economics on the theory that it was more “useful” in case grad school did not work out. I chose the University of Rochester because they then had a reputation in mathematical economics and I was naïve enough to think that this is what I wanted to study, having enjoyed a course using the classic text by James M. Henderson and Richard E. Quandt. However, my first semester in graduate school convinced me that I was not going to be a theorist. (My friend and classmate Jerry Green gave me a good standard to which I could compare myself, and I knew I was not in his league.) Instead I focused on more applied fields, including labor, public finance, health economics and economic history. For the latter subject I was lucky enough to study with Robert Fogel, who almost made economic history come to life, but not quite enough to get me excited about spending my career looking at old documents in the library. The Rochester economics department was a striving place in those years. Several stars passed through on their way to careers elsewhere, including Robert Barro and Rudy Dornbush. The faculty I spent the most time talking to were Stan Engerman and Rudy Penner.

Eventually I focused on health economics working with the then department chair, Richard Rosett, whose wine buying habits were later featured in my research. We had picked a potentially interesting problem for my thesis, which was to try to explain why infant mortality rates were so much higher for African American mothers than for whites. A regression putting all of the plausible explanatory factors on the right-hand side (including income, education, whether the birth took place in a hospital, etc.) could only reduce the discrepancy by about half. Truthfully, it did not make a great job market paper, though I think a later version of me might have been able to give the article a more interesting spin by calling the result a puzzle. Since this was just my fourth year in graduate school, waiting to leap into the job market would have made sense, as is commonly done. But in those days lingering was not an option. My funding was ending, and I had a family to support so had little choice. Despite some promising fly-outs, I did not end up with a job offer at an attractive research-oriented university, and I decided to take a job in the Washington D.C. office of an economics consulting firm whose headquarters were (and remain) in Princeton, New Jersey.

Late in the week before I was supposed to start work I got a call asking if I could fly down to Princeton from Rochester to talk about my new job. When I arrived, I was shocked to learn that the purpose of the meeting was to fire me. It seems that the Washington office was not doing as well as they had hoped. They offered to pay for my moving expenses to Washington and give me a month’s pay. This was on Thursday; the moving trucks were due to arrive Monday. Meanwhile, there was a hiring freeze in place for the Federal government. After unsuccessfully pleading my case, I rushed back to Rochester to figure out what to do. It made no sense to move to Washington with no job prospects, but the lease on our grad student housing apartment was also running out on Monday, so we were about to be jobless and homeless. Not good.

Fortunately, the last two years that I was in graduate school in the economics department I had been teaching at the Rochester Graduate School of Business to earn some extra money. I had gotten to know the Dean, Bill Meckling, and so I called him in a panic begging for a job for a year. It turned out that they had a couple courses that were unstaffed, and Bill made me an offer the next day. Someone found us another apartment to live in and the movers ended up just taking us across campus rather than down to Washington. We survived, though a few days later I came down with a strange illness that made me as sick as I have ever felt. Stress is like that.

This bit of bad and good luck gave me a second chance at writing a thesis and I decided to make the best of it. I had an idea for a research project that I was intending to work on as soon as my thesis was done, and I decided to make the rash decision to just abandon the first thesis topic and switch to my new idea: how to put value on saving a human life.

This research idea came from the course on cost-benefit analysis I had been teaching in the business school. Many government programs, from highway safety to environmental regulations to health care provisions have, as one of their outcomes, a change in the life expectancy of some segment of the population. What is that worth? The method then in place was to value the lives saved (or prolonged, really) by calculating the loss in human capital their deaths would entail — i.e., how much earnings they would lose minus what they would have consumed. This struck me as a preposterous idea. For one thing, prolonging the life of a retired person would have no value, or perhaps a negative value, since retired people consume more than they earn. I had read an article by Tom Schelling (1968) that sketched out what seemed to be a much more sensible frame-work based on willingness to pay for changes in the probability of death, but no one had been able to figure out a way to estimate a value based on this conceptual framework.

My thought was that it might be possible to estimate the value people put on their own lives by looking at how much people had to be paid to be willing to take risky jobs such as mining or logging. The main problem I had was to find a source for occupational mortality rates. It finally occurred to me to ask my father, the actuary, whether he might be able to find such data. He promised to look around and struck gold. He soon sent me a study sponsored by the Society of Actuaries that had exactly the data I needed, published in a thin red book. I was in business.

This project had turned into a labor economics exercise, so I went to talk to Sherwin Rosen, then a young professor in Rochester who had received his Ph.D. from Chicago. He liked the problem and agreed to become my new advisor. As we worked on the project the more general problem of what he called “hedonic prices” captured his attention, and this led to his well-known paper on the subject (Rosen, 1974). We co-authored a paper based on my thesis (Thaler and Rosen, 1976) that became quite well-known, and the technique for valuing lives saved that we advocated is now widely used. (See Viscusi and Aldy, 2003).

While working on my thesis, I decided that it might be interesting to do an informal survey of people’s attitudes toward the risk of death. However, I was not sure whether I should ask about people’s willingness to pay or their willingness to accept so I did both, sometimes using a within-subject design in which people answered both questions, such as these:

Assume you have been exposed to a disease which if contracted leads to a quick and painless death within a week. The probability you have the disease is 0.001. What is the maximum you would be willing to pay for a cure?

Suppose volunteers were needed for research on the above disease. All that would be required is that you expose yourself to a 0.001 chance of contracting the disease. What is the minimum you would require to volunteer for this program? (You would not be allowed to purchase the cure.)

Theoretically the answers to these two questions should be approximately the same, with differences only attributable to income effects.1 But I was stunned when I saw the results. Typical respondents offered answers that differed by one or two orders of magnitude, and a non-trivial number of people said they would not agree to participate in the program described in version B for any amount of money. I thought this was interesting and showed the result to Sherwin, but he was unimpressed and told me to go back to work on my econometrics exercise.2

While I followed Sherwin’s instructions to get back to work on my thesis, I was intrigued by my survey results, and it started a new interest. I began collecting examples of people behaving in ways that were inconsistent with economic theory and put a list of them on my office blackboard. The topics included other examples of buying and selling prices diverging, people failing to ignore sunk costs, and struggles with self-control problems. Most of the economists with whom I shared these examples found them more annoying than interesting, and I was not at all sure that there was anything resembling “research” that could come from this collection of stories.

Then I had a lucky break. In the summer of 1976 Sherwin and I went to an interdisciplinary conference held at Asilomar, a rustic conference center near Monterey, California to present some new research on the value of a life. At the conference there were two psychologists, Baruch Fischhoff and Paul Slovic, who hailed from an independent think tank in Eugene, Oregon and were presenting some research on how people (mis)perceive risk. At the end of the conference I offered Fischhoff a ride back to the San Francisco airport, which gave us a couple hours to talk. I learned that Fischhoff had done his graduate work in Israel at the Hebrew University. I told him about my list of peculiar economic behavior and he said that I might want to read some of the research by his two thesis advisors, whom I had never heard of: Daniel Kahneman and Amos Tversky. I wrote down their strange sounding names so that I would not forget them.

When I returned to Rochester (where I now had a job as an assistant professor at the Graduate School of Business) I went to the library, found the psychology section, and started devouring the early Kahneman and Tversky papers on human judgment. Reading those papers created the sort of “ah ha” moments that one imagines are routine in academic life, but in fact are rare treasures. The insight was that when people use simple rules-of-thumb or “heuristics” to make predictions, they make systematic errors. The key phrase was “systematic error”.

This phrase was the key to making use of the idea that people have limited rationality, as famously explored by Nobel laureate Herbert Simon a decade earlier. At some level the idea that people are only boundedly rational was unchallenged even by the most ardent defenders of rational choice theory. (They knew plenty of individuals they thought to be quite irrational …) But no one could specify how the behavior of boundedly rational agents differed from those with complete rationality. Here was Kahneman and Tversky’s key insight: if people make systematic mistakes, their behavior is predictably different from that implied by rational choice models. That seemed to me to be a big deal.

I wrote to Fischhoff to thank him for the tip and share my excitement, and he told me about a new paper that Kahneman and Tversky (K&T) were working on, something they called “value theory”. He thought that economist Howard Kunreuther might have a copy. I called Howard who sent me a copy complete with his comments scrawled in the margins. Value theory turned out to be the working title for what later became Prospect Theory, and in this paper Kahneman and Tversky were working on issues directly related to the items on my list. Specifically, the value function at the heart of the theory had “loss aversion” as an integral component. Loss aversion leads directly to a discrepancy between willingness to pay and willingness to accept. The answers people were giving to my value of a life questionnaire were a little less mysterious, and I was captivated.

I soon learned that K&T were planning to spend the following academic year, 1977–1978, visiting Stanford. I had already been planning to spend the summer of 1977 at Stanford working with Sherwin on some new projects, so I set out to find a way to stick around for at least a semester to meet my new heroes. In another bit of good luck I met Victor Fuchs, the now legendary health economist, who was then running the west coast office of the National Bureau of Economic Research (NBER) where Sherwin and I would be working. For reasons that I will never know, Victor agreed to put me on his grant, which allowed me to stay for the fall, and he eventually paid for my visit for the entire year. That year literally changed my life, and rather directly led to this prize.

2. Going all in

In June, 1977 the Thaler family (Dee, Greg and Maggie aged 11 and 8 – Jessie was not yet born) loaded up our station wagon and took a leisurely trip across the country to eventually arrive at Stanford. One of our last stops was in Eugene, Oregon where Fischhoff and Slovic were located. I met with them along with Sarah Lichtenstein, who also worked at their organization, Decision Research, and Maya Bar Hillel, another K&T student who was hanging out for the summer. They all became the initial members of my psychology support team. By this point I had written a draft of what would eventually become my first behavioral economics paper (Thaler, 1980) titled “Toward a Positive Theory of Consumer Choice.” I was beginning my process of sending the paper to journals and waiting for it to be rejected. K&T arrived at the end of the summer and we were soon introduced.

Figure 1. Thaler at NBER-West, 1978.

Photo by Hersh Shefrin.

Photo by Hersh Shefrin.

It turned out that Danny (as I learned everyone called Kahneman) was visiting the Center for Advanced Study in the Behavioral Sciences, which was located about 200 meters up the hill from NBER. I soon began visiting Danny on a regular basis and we would often take long walks in the hills nearby talking about psychology, economics, and life. (It would become a life-long conversation that we still pursue.) It turned out that Amos and Danny knew roughly as little about economics as I did about psychology, so we were able to learn a lot from each other. Later in the year I audited a Ph.D. course Amos was teaching in the psychology department on judgment and decision-making. I had no teaching responsibilities that year so I had plenty of time to think, and about once a week Victor (my benevolent benefactor) would stop by to ask me what was new. It turned out that Victor was an excellent inducer of guilt, so I was under a lot of pressure to have something new to talk about the next time he dropped by.

At this point I was a third-year Assistant Professor at Rochester and I had a big decision to make. Along with my thesis paper with Sherwin I had written a couple papers on the economics of crime, but it was clear that my passions were captured by this tantalizing combination of psychology and economics. At some point during the fall I decided that I was going to commit my research efforts to that topic full time, and that it would be wise to look for a job somewhere other than Rochester. I had two reasons for wanting to move. First, most of the faculty at the Rochester business school was not enthusiastic about my new line of research. They had recently been described in some magazine article as a University of Chicago “farm club” (a baseball expression for a minor league affiliate). Milton Friedman was considered a god, and Michael Jensen, the most prominent faculty member, was a recent Chicago graduate with a strong belief in rational choice models and efficient markets. My second reason for looking to move was that I realized this new research agenda was highly risky and progress might take time (especially since my first paper kept getting rejected) so I was hoping to land somewhere and restart my tenure clock.

I ended up getting an offer from the business school at Cornell, just a two-hour drive southeast from Rochester. The job opening for which I had applied was to teach public economics, which was consistent with my recent publications, but I wanted to make sure that any potential employer would not be surprised by my new peculiar research interests, so the paper I used for my job talk was an early draft of “An Economic Theory of Self-Control” (later published as Thaler and Shefrin, 1981). I figured any school that would hire me based on that paper would give me the freedom I would need going forward.

I stayed at the Cornell business school for 18 years, seeing it become the Johnson School of Business Administration, and it proved to be an ideal place for me to take the risks that would be necessary to try to pursue a new way of doing economics. I soon made friends in the psychology department (especially Tom Gilovich and Dennis Regan), hired some likeminded economists at Johnson (Bob Gibbons, Mike Waldman, and Bob Frank, recruited over from the economics department) and found some good students to work with.

3. Finance

My first graduate student was Werner De Bondt, whom I had recruited from the Cornell MBA program. I had gotten him interested in behavioral economics, but his specialty was finance, so he wanted to write his thesis on some topic in financial economics. I had picked up some knowledge of finance while at Rochester since it was a focus there, but had never had a course on the subject so Werner had to do the heavy lifting. We published a paper based on his thesis (De Bondt and Thaler, 1985).

The way that paper came to be published is an interesting story. My co-author on the self-control papers, Hersh Shefrin, had started dabbling in finance as well, and had been asked to organize a session at the American Finance Association annual meeting. At that time, one issue of the Journal of Finance each year consisted of a selection of papers that had been presented at the annual meeting. The current president of the Association, which that year happened to be Fischer Black, picked the papers. Black, of course, is the co-inventor of the Black-Scholes formula, and someone who would certainly have shared the Nobel Prize won by Robert Merton and Myron Scholes had he still been alive. Fischer had eccentric tastes (his presidential address that year had the one-word title “Noise”) so he picked our paper (with the help of a nudge from Hersh), which meant it was published without the usual referee process. I am convinced that sped up the process of publication by at least two years.

The paper caused a bit of a stir in finance and my papers were still being largely ignored in other fields, so I was up for writing more. De Bondt and I collaborated on two more and then I wrote a series of papers a young colleague, Roni Michaely, and with a series of Cornell doctoral students including Charles Lee, Kent Womack, and Shlomo Benartzi. The paper with Charles Lee was joint with Andrei Shleifer.

Over time Benartzi became my most frequent co-author. There are two reasons for that. First, he is a very creative guy who comes up with a ton of interesting ideas. Second, he excels at getting me to work. Others have tried to learn his secret, but he holds his cards close to his chest.

4. Another year with Danny

After our year at Stanford, Amos and his wife Barbara took jobs in the Stanford psychology department and Danny and his wife Anne Treisman moved to the University of British Columbia in Vancouver. After six years we all had earned sabbatical leaves (and I had managed to get tenure). Because the year at Stanford had been so productive I naturally thought about trying to visit either Amos or Danny, but there was no real choice to make. Amos was planning to spend the year back in Jerusalem and my wife Dee vetoed a visit there, whereas Danny was planning to spend the year at home in Vancouver because Anne’s youngest daughter Deborah was in high school and did not want to leave. I asked Danny if he was up for having a visitor and he quickly agreed. We would have another year to spend thinking, talking, and taking long walks (when it wasn’t raining).

It turned out that when I arrived in late summer 1984, Danny had just begun collaborating with the economist Jack Knetsch, who also lived in Vancouver, teaching at Simon Fraser. Jack and I had more or less independently stumbled upon the discrepancy between buying and selling prices, what I called the “endowment effect”, and he had run a clever early experiment cleanly demonstrating the phenomenon. And though we would later return to that shared interest, the project they had just started was on a new topic: fairness.

Specifically, the question we were interested in was finding out what actions by firms people consider to be unfair. Another way to put it would be: when do firms make people angry? The technique we used was to devise scenarios of interest and then make use of some free telephone polling services Jack had procured to find out what (Canadian) people think. Coming up with interesting stories is a skill that is rarely in high demand in economic research, but for this paper it was crucial, so I had no trouble contributing to the team. We also had a lot of fun. And for the only time in my life, the referees liked the paper at least as much as we did, so it was accepted at the American Economic Review with barely a revision. (It helped that one of the referees was George Akerlof, another iconoclast.)

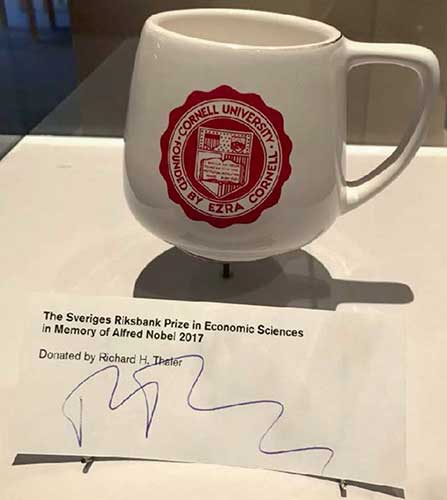

The three of us also began another project that returned to the interest Jack and I shared in the endowment effect. The goal of the experiment was to show that the endowment effect could survive a setup in which the subjects traded in markets for real money and had opportunities to learn. I ran an early version of our design when I got back to Cornell, and went over to the bookstore to look for some inexpensive object we could use in the experiment that students might like. Somehow a coffee mug with the Cornell insignia caught my eye and we used a set of those for subjects to trade. For some unknown reason, university coffee mugs have become a mainstay in the dozens of subsequent versions of this experiment. I had kept one of the original mugs as a memento so when I was asked to donate something to the Nobel Museum I had an easy choice.

Figure 2. Cornell Mug at Nobel Museum:

Photo by France Leclerc.

Photo by France Leclerc.

5. Anomalies

Shortly after returning from Vancouver I was having dinner with Hal Varian, the economist who went on to become the chief economist at Google. Hal was telling me about a new journal the American Economic Association was launching called the Journal of Economic Perspectives. The first editors were going to be Joe Stiglitz and Carl Shapiro. The idea for the journal was to publish readable articles that were aimed at a general audience of economists rather than specialists in a specific subfield such as international trade or corporate finance. Like any science, economics has become increasingly specialized and it can be hard for those in one area to understand the latest research in fields outside their own. In a brilliant move, the journal also hired Timothy Taylor, an economist who can write, as managing editor, a job he still holds nearly 30 years later. Tim makes every article that appears in the journal better.

Hal, who was a member of the editorial advisory board, told me that the journal wanted to include some recurring features, and they were looking for suggestions. At some point we came up with the idea for a regular column on “Anomalies” that I would write, recruiting co-authors as appropriate. Hal pitched the idea to Joe, who happily agreed. I would be committed to produce one column each issue, meaning four a year. The columns were about 12 journal pages so there was room to go into some detail. This was going to be a lot of work, and it was risky. More than one senior faculty member told me that these publications, since they would not appear in a “refereed” journal, would not “count”, whatever that means. I suppose if I did not already have tenure this might have dissuaded me, but fortunately that hurdle had been cleared and I loved the format. This was a chance to write articles without having to spend endless time trying to satisfy hostile referees. More important, I thought that if I did this right, I would have a unique platform to reach new readers, particularly young readers whose opinions were still malleable.

My goal was to cover a lot of different topics, each detailing empirical facts that appeared to be inconsistent with economic theory. The topics varied from seasonal patterns in the stock market, to betting odds at the racetrack, to industrial patterns in wages (why some industries pay receptionists more than others), to cooperation in games. The best part of writing these columns was that instead of referees I got intelligent, constructive comments from Carl, Joe and Tim. In the end it was a gamble that paid off. Lots of economists have told me that they first became aware of behavioral economics by reading these columns.

6. The Russell Sage Foundation

That year in Vancouver was made possible, in part, by Eric Wanner, whom I had met a couple years earlier. He would later become a longterm supporter (and constructive critic) of behavioral economics and a good friend. Eric, who had a Ph.D. in psychology, was working as a program officer at the Alfred P. Sloan Foundation and had gotten the idea that it might be smart to support research that tried to combine psychology and economics. He met with Amos and Danny at a conference to talk about the idea and Danny famously told him “well, it is not a project on which one could spend a lot of money honestly”. Danny, bless his heart, has a well-deserved reputation as a pessimist. But Amos and Danny did suggest that Eric talk to me, so I made the trip down to New York to meet him. Sometime later he made his first grant, which was to support my year in Vancouver. But Eric was just getting started.

Eric soon left to become the President of the smaller Russell Sage Foundation (RSF) and brought his interest in psychology and economics with him. RSF soon started a modest program in behavioral economics, which included hosting occasional conferences. I remember one meeting where we tried to interest psychologists in talking to economists and we attracted an all-star lineup including the intellectual giants Leon Festinger, Stanley Schachter, and Walter Mischel, along with Amos and Danny of course. But, although the meeting was thoroughly enjoyable, this ended up being a blind alley. Aside from Amos and Danny and a handful of other psychologists such as Eric Johnson, Drazen Prelec and Eldar Shafir, behavioral economics has become a field dominated by economists. One plausible explanation is the high entry barriers to psychologists who want to publish in economics journals. Another is that many people just find economics (and economists) boring.

Another conference that started as a one-off meeting turned into a surprising success. This was a meeting on behavioral finance that Robert Shiller and I organized. Bob and I did this for a few years at RSF but we outgrew their meeting space and shifted the conference to the auspices of NBER, where we had meetings twice a year. Bob and I organized this conference for nearly 30 years.3 Many of the most important contributions to behavioral finance were first presented at those meetings.

At some point the Russell Sage board created a group of key members of the behavioral economics community, gave us a small pot of money and told us to spend it in whatever way seemed best. This sort of laissez-faire grant making from foundations is highly unusual, which is too bad because it led to two highly successful programs. One designated an amount of money that would be given out in small grants to graduate students and new faculty members. Typical grants were just a few thousand dollars and many led to good publications. The other idea was more ambitious, and it came from Danny. We started a two-week long bi-annual summer institute for graduate students, known to all as the Russell Sage summer camp. Colin Camerer, Danny and I organized the first one in 1994 in Berkeley, and with no track record we managed to attract an amazing group of students. Those included Linda Babcock, Christine Jolls, David Laibson, Sendhil Mullainathan, Terry Odean, and many more. We also had Matthew Rabin, a young assistant professor, serving as a sort of counselor in training. The faculty was not bad either. It included (according to my memory) George Akerlof, Ken Arrow, Vernon Smith, Richard Zeckhauser and the psychologist Lee Ross. The camp continues running every other year to this day, usually around the time of the soccer World Cup. For a period, Colin Camerer and George Loewenstein were the organizers but for more than a decade David Laibson and Matthew Rabin have organized it. I have yet to miss one. There is a tradition of making t-shirts for each of the summer camps. That early morning in October when I got a 4 am wake-up call from Stockholm I was told to get some coffee and get ready for a telephone press conference in 45 minutes. I showered, and put on one of those old camp t-shirts for the press conference.

Figure 3. France Leclerc and Thaler wearing RSF Summer Camp T-shirt, after getting the call.

Photo: Anne Ryan.

Photo: Anne Ryan.

Russell Sage also hosts a visiting scholar program. In 1991-92 it had been another seven years since Vancouver and Danny and I applied to be visiting scholars at RSF. We were joined by Colin Camerer and Amos came for periodic visits. Danny and I tried to recreate the magic from our previous stints, but we were unable to pull it off. It didn’t help that during the year his Berkeley home had burned to the ground in a massive fire and I was going through a divorce, but I think mostly we had both gotten too busy to work seven days a week on one thing. Nevertheless, in various combinations, Colin, Danny and I wrote three papers that year on what we called “narrow framing”.4 We also managed to have a lot of fun.

7. Chicago

During my year in New York I began dating a marketing professor at MIT named France Leclerc. The following year I spent a semester visiting MIT, then she came to Cornell for a year, then I went back to MIT for a year. Apparently someone at the University of Chicago noticed this “co-movement” and we both received offers to join what is now called the Booth School of Business. We married the following year. Since then France has changed careers and has become a photographer seeking out and capturing images of ancient cultures while it is still possible to find them.

The University of Chicago may be the most intense intellectual environment in the world. I had been hired to help build a group of behavioral scientists that would include cognitive and social psychologists and behavioral economists. In the years that I have been there I have learned a lot of psychology from that group of colleagues. But for me the best part of being a faculty member at Booth is that it is so easy to cross disciplinary borders. I continued writing finance papers but now with new Booth collaborators such as Nick Barberis and Owen Lamont, and I could get the efficient markets take on any idea just by wandering down the hall to Gene Fama’s office, or better yet, joining him for a round of golf.

Oddly, my most important collaboration at the University of Chicago was with a law professor who was the first person to reach out to me when he heard I was coming: the incomparable Cass Sunstein. We were colleagues at Chicago from 1995, when I arrived, to 2008 when he went off to work for President Obama and then later to join Harvard Law School. Our first collaboration was on a paper with former summer camper Christine Jolls that was titled “A Behavioral Approach to Law and Economics” (Jolls, Sunstein and Thaler, 1998). That paper was at least as controversial at the Chicago Law School as my papers with De Bondt had been over in the finance department at Booth.

The University of Chicago was the spiritual home of law and economics with scholars such as Ronald Coase, Richard Epstein and the formidable Richard Posner. Posner, a prodigious scholar, for many years did double duty as a Justice on the U.S. Court of Appeals, the court one step below the Supreme Court, and as a “part-time” professor who wrote at least one book a year. The seminar where we presented our paper was as raucous as any I have ever attended. Many in the audience seemed to think that using coffee mugs to test the Coase theorem was tantamount to heresy. Later Cass and I would go on to write the book Nudge. Writing that book changed our lives and, somewhat miraculously, caught the fancy of both academics and policy makers around the world. As I write whenever anyone asks me to sign a copy of the book, I hope they all use what we wrote to “nudge for good”.

8. Friends and collaborators

I have been a very lucky man. The academic life can be solitary, especially when many of your colleagues think you are nuts. I have been fortunate to have had a fabulous set of collaborators, all of whom became friends. Without supportive friends in graduate school, especially Dipankar Dasgupta and Robin Mukerjee, I would not have survived the first year. Without Sherwin I would not have written that thesis. Then there was Hersh Shefrin, my fist behavioral co-author on the self-control work, and Tom Russell, another friendly voice at Rochester until they both abandoned me for sunny California. Of course, none of this would have happened without Amos and Danny. We lost Amos all too soon in 1996 at the age of 59. Danny and I remain dear friends.

Figure 4. Thaler extended family celebrating in Stockholm.

I am admittedly a rabble rouser who enjoys stirring the pot and challenging conventional wisdom. But taking on that role brings an emotional burden: it is not easy having economists you admire dismiss your research because it does not follow existing norms. Throughout my life, my friends, family, co-authors, and colleagues have given me more than just ideas and feedback; they have sustained my courage and moderated the volatility of my ego.

To everyone who has helped over the years, I can only say thank you. I wish you could have all joined us in Stockholm. And as Danny always says when we finally have to stop talking: “to be continued”.

Figure 5. Kahneman and Thaler, still hard at work …

Photo by John Brockman.

Photo by John Brockman.

1. To mitigate liquidity constraints in some versions I offered people the option to finance their payment in the willingness-to-pay condition with a thirty-year loan at zero interest.

2. Sherwin and I remained friends and were colleagues for a while at Chicago some years later, but he never became a fan of behavioral economics. One day I teased him that if he wasn’t nice to me I would write a book and say that he had taught me everything I knew.

3. You can find the programs on his website: http://www.econ.yale.edu/~shiller/behfin/index.htm.

4. Linda Babcock, Colin, George Loewenstein and I wrote a paper on the behavior of New York City taxi drivers (Camerer et al, 1997), Danny and Dan Lovallo (Kahneman and Lovallo, 1993) wrote one on managerial decision making, and Benartzi and I wrote about the equity premium puzzle (Benartzi and Thaler, 1995)… The same theme was the basis for the only paper Amos, Danny and I ever wrote together (Thaler, Tversky, Kahneman and Schwartz, 1997) …

References

De Bondt, Werner F. M. and Richard H. Thaler. 1985. “Does the Stock Market Overreact?” The Journal of Finance 40(3): 793–805.

Rosen, Sherwin. 1974. “Hedonic Prices and Implicit Markets: Product Differentiation in Pure Competition.” Journal of Political Economy, 82: 34–55.

Schelling, Thomas C. 1968. “The Life You Save May Be Your Own.” Problems in Public Expenditure Analysis, 127–162. Washington, DC: Brookings Institution.

Thaler, Richard H. 1980. “Toward a Positive Theory of Consumer Choice.” Journal of Economic Behavior and Organization, 1: 39–60.

Thaler, Richard H. and Hersh M. Shefrin. 1981. “An Economic Theory of Self-Control.” Journal of Political Economy, 39(April): 392–406.

Thaler, Richard H. and Sherwin Rosen. 1976. “The Value of Saving a Life: Evidence from the Labor Market.” Household Production and Consumption, National Bureau of Economic Research, Inc.: 265–302.

Viscusi, W. K. and Joseph E. Aldy. 2003. “The Value of a Statistical Life: A Critical Review of Market Estimates Throughout the World.” Journal of Risk and Uncertainty, 27(1): 5–76.

Nobel Prizes and laureates

Six prizes were awarded for achievements that have conferred the greatest benefit to humankind. The 12 laureates' work and discoveries range from proteins' structures and machine learning to fighting for a world free of nuclear weapons.

See them all presented here.